[ad_1]

My purpose with Finxter is that can assist you keep on the suitable facet of change. I firmly imagine that within the subsequent many years, it is advisable be an asset holder and proprietor reasonably than simply being a employee bee being more and more changed by automation.

However what investments to carry to be on the suitable facet of change? I like easy investments so I’ve requested GPT-4 to supply easy and “painfully apparent” investments in a hypothetical state of affairs wanting again from 2030 to 2023. Let’s name it GPT-4’s Hindsight Portfolio.

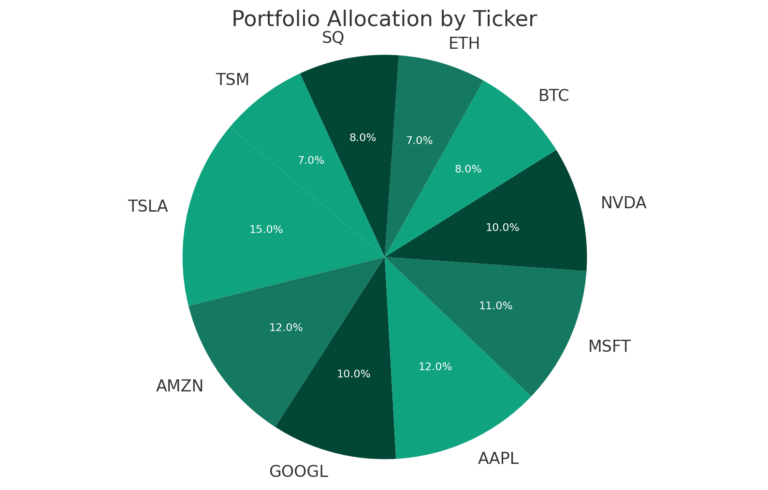

Right here’s a structured desk outlining the funding names, tickers, allocation percentages, and compound annual progress charges (CAGR) for the Hindsight Portfolio from our hypothetical state of affairs wanting again from 2030:

📈 Disclaimer: These are usually not my suggestions. I can not give funding recommendation as a result of I’m not an funding advisor. Nevertheless, I personally personal a few of these investments already.

| Funding Title | Ticker | Allocation % | CAGR |

|---|---|---|---|

| Tesla, Inc. | TSLA | 15% | 58% |

| Amazon.com, Inc. | AMZN | 12% | 52% |

| Alphabet Inc. | GOOGL | 10% | 47% |

| Apple Inc. | AAPL | 12% | 44% |

| Microsoft Company | MSFT | 11% | 40% |

| NVIDIA Company | NVDA | 10% | 55% |

| Bitcoin | BTC | 8% | 63% |

| Ethereum | ETH | 7% | 65% |

| Block, Inc. (previously Sq., Inc.) | SQ | 8% | 50% |

| Taiwan Semiconductor Manufacturing Firm | TSM | 7% | 46% |

Every funding listed is accompanied by its compound annual progress charge (CAGR) from 2023 to 2030, showcasing how a diversified portfolio may need allotted property to those “apparent” winners.

Tesla, Inc. (TSLA)

Tesla’s pioneering function within the EV market and its growth into renewable vitality sectors made it an evident chief within the inexperienced revolution.

CAGR: 58%

Portfolio Allocation: 15%

Reflection: The juggernaut of innovation, Tesla didn’t simply keep its lead in electrical autos; it expanded into full vitality options, solidifying its place in each side of the sustainable future.

Amazon.com, Inc. (AMZN)

Amazon’s dominance in on-line retail and its main place in cloud computing companies had been clear indicators of its progress trajectory.

CAGR: 52%

Portfolio Allocation: 12%

Reflection: Amazon continued to be the the whole lot retailer, however its progress was supercharged by its cloud companies division, which turned important infrastructure for the burgeoning digital financial system.

Alphabet Inc. (GOOGL)

With Google’s unparalleled knowledge community and funding in cutting-edge applied sciences, Alphabet was an apparent alternative for long-term progress.

CAGR: 47%

Portfolio Allocation: 10%

Reflection: Alphabet’s huge portfolio of expertise ventures, from AI to biotech, proved to be greater than experimental; they turned market leaders, driving unbelievable progress.

Apple Inc. (AAPL)

Apple’s constant innovation, model loyalty, and growth into new product classes made it a transparent wager for sustained success.

CAGR: 44%

Portfolio Allocation: 12%

Reflection: The titan of tech, Apple’s continued evolution of its product ecosystem, together with a foray into autonomous autos, stored it on the forefront of shopper expertise.

Microsoft Company (MSFT)

Microsoft’s entrenched place in enterprise software program and speedy progress in cloud companies marked it as an apparent funding for regular returns.

CAGR: 40%

Portfolio Allocation: 11%

Reflection: A silent however formidable big, Microsoft’s cloud companies and enterprise software program solidified its place as an indispensable a part of world enterprise infrastructure.

NVIDIA Company (NVDA)

NVIDIA’s dominance in GPUs and the rise of AI and gaming made it a transparent beneficiary of tech developments.

CAGR: 55%

Portfolio Allocation: 10%

Reflection: NVIDIA remained important, as its GPUs powered the whole lot from essentially the most superior AI algorithms to the metaverse, and its progress mirrored this centrality.

Bitcoin (BTC)

Bitcoin’s first-mover benefit and rising mainstream acceptance as a digital asset made it an apparent alternative for high-yield returns.

CAGR: 63%

Portfolio Allocation: 8%

Reflection: Bitcoin emerged not simply as a retailer of worth, however as a foundational asset within the new age of digital finance, gaining widespread institutional acceptance.

Ethereum (ETH)

Ethereum’s place because the main platform for decentralized functions pointed to its vital potential for progress.

CAGR: 65%

Portfolio Allocation: 7%

Reflection: With profitable protocol upgrades, Ethereum turned the spine of the decentralized net, resulting in mass adoption of its good contract platform.

Block, Inc. (SQ)

Block’s modern strategy to integrating digital funds and cryptocurrencies positioned it as a transparent chief within the fintech area.

CAGR: 50%

Portfolio Allocation: 8%

Reflection: Block’s integrative strategy to finance and cryptocurrency positioned it completely on the crossroads of fintech innovation, resulting in exponential progress.

Taiwan Semiconductor Manufacturing Firm, Restricted (TSM)

TSMC’s standing because the world’s main semiconductor foundry made it an apparent decide in an more and more chip-dependent tech panorama.

CAGR: 46%

Portfolio Allocation: 7%

Reflection: The unsung hero, TSM’s function in powering the semiconductor wants of a tech-hungry world drove its progress to new heights, making it the bedrock of the digital age.

Concluding Ideas on GPT-4’s Hindsight Portfolio

Apparently, the “Hindsight Portfolio” of 2030 illustrates the monumental affect of megatrends equivalent to sustainable vitality, e-commerce proliferation, cloud computing, AI developments, and the ubiquity of digital finance.

- Tesla benefited from the inexorable shift in direction of inexperienced vitality and electrical autos.

- Amazon and Alphabet capitalized on the large surge in on-line companies and the integral nature of AI throughout industries.

- Apple and Microsoft continued to develop their technological ecosystems, embedding themselves additional into the material of every day life and enterprise operations.

- NVIDIA‘s {hardware} turned the spine of AI and gaming, industries that skilled explosive progress.

- Cryptocurrencies, with Bitcoin and Ethereum main the cost, redefined asset courses and opened new avenues for world transactions.

- Block, previously Sq., turned synonymous with fintech innovation, bridging the hole between conventional finance and the rising digital financial system.

- And TSMC, the silent titan of semiconductors, enabled the technological leaps of numerous industries.

Every funding car, in its approach, rode the wave of its respective megatrend that, in hindsight, looks like the obvious funding selections of the final decade.

Whereas working as a researcher in distributed programs, Dr. Christian Mayer discovered his love for educating laptop science college students.

To assist college students attain larger ranges of Python success, he based the programming training web site Finxter.com that has taught exponential abilities to thousands and thousands of coders worldwide. He’s the writer of the best-selling programming books Python One-Liners (NoStarch 2020), The Artwork of Clear Code (NoStarch 2022), and The E-book of Sprint (NoStarch 2022). Chris additionally coauthored the Espresso Break Python sequence of self-published books. He’s a pc science fanatic, freelancer, and proprietor of one of many high 10 largest Python blogs worldwide.

His passions are writing, studying, and coding. However his biggest ardour is to serve aspiring coders by way of Finxter and assist them to spice up their abilities. You may be a part of his free e-mail academy right here.

[ad_2]